Property Tax Foreclosure Macomb County Michigan

Macomb County Tax Foreclosure Timeline

Tax foreclosure deadlines in Macomb County MI are based on a 3 year timeline. In other words, from any tax year, you have 3 years to pay all back due taxes, fees and interest before your home is foreclosed on.

For example, the following Tax Foreclosure Timeline for Macomb County MI is based on tax year 2020. The first major milestone coming in March of 2021.

March 2, 2021 (+1 year from tax year in question)

- Unpaid 2020 Property taxes become delinquent and payable to Macomb County Treasurer

- 4% Administation fee and 1% interest added

- Interest begins to accrue at 1% per month, added on the 1st day of the month

June 1, 2021

- Notice sent via first class mail

September 1, 2021

- Notice sent via first class mail

October 1, 2021

- $15 fee added

February 1, 2022

- Notice sent via certified mail informing parties of interest that property will be forefeited and additional fees and interest added

March 1, 2022 (+2 years from tax year in question)

- Property is FOREFEITED – this is the start of the foreclosure process

- Minimum $175 title search fee added plus recording fees

- Interest rate increases to 1.5% per month retroactive to date of delinquency

Mid June 2022

- Foreclosure filed in Circuit Court

September 1, 2022

- $50 Personal Visit Fee added

- Each property visted by Treasurer’s Office Staff and notice of the foreclosure is provided

November, 2022

- $35 Publication fee added

- Certified mail fee added

December, 2022

- Notice of Show Cause and Judicial Foreclosure sent via certified mail

- Forefeited parcels published in local newspaper

January 2023

- Showcause Hearing Held by Treasurer to contest foreclosure or discuss payment plans

February 2023

- Circuit Court Foreclosure Hearing and entry of Foreclosure Judgement

March 31, 2023 (+3 years from tax year in question)

- Property FORECLOSED; title to property passes to the county treasurer. This is when you actually LOSE YOUR HOUSE!

- Right to redeem property expires

- Final payment date to avoid foreclosure, unless you have a formal extension agreement on file with the Treasurer’s Office and filed in the foreclosure action.

July 1, 2023

- Deadline for those who held title or an equity interest in property at the time of foreclosure to file to claim leftover proceeds, if any, associated with

September/October 2023

- Property is sold at public auction

January 31, 2024

- Deadline for Treasurer to send notice to claimant to file motion with the Circuit Court

May 15, 2024

- Deadline for claimant to file motion with circuit court for surplus proceeds

The Effects of Tax Foreclosure in Macomb County Michigan

- Loss of your home – Pretty self-explanatory here. The major result of a tax foreclosure in Macomb County Michigan is the loss of your home.

- Decrease in Your Credit Rating – Your credit rating will be lowered by the foreclosure. How much? It depends on how high your current credit score is… but the higher your current credit score… the more your score will drop after a foreclosure. If you have a credit score of 680 or higher… you may see a drop of 100+ points.

- Depression and Stress – Your mental health is at stake because of the high pressure situation. Going through a foreclosure is emotionally exhausting and frustrating to say the least.

- House Values In Your Community – Another one of the big foreclosure effects in Macomb County Michigan is that they tend to lower the overall value of the houses in your neighborhood… especially if there are multiple foreclosures in the immediate area.

How Can You Avoid a Tax Foreclosure in Macomb County MI?

For the well being of you and your family, you need to mitigate the effects of foreclosure as much as you can. The process can be frustrating and time consuming, but there are people who can help you navigate your different options in the process.

Call your county and work with them

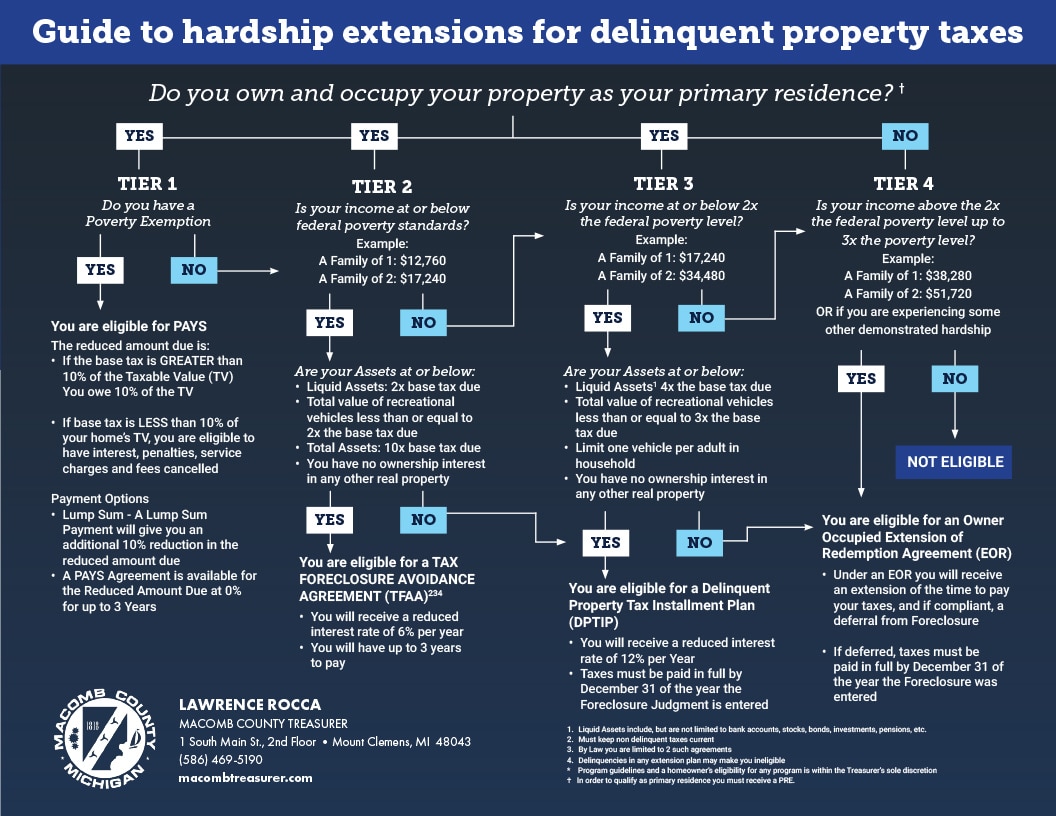

Macomb County can offer payment plans and assistance if you fall behind on your property taxes.

Resource: Macomb County Treasurer Tax Foreclosure Prevention

Sell your property to a local investor like us

If you’d rather find a way to sell your house and avoid the foreclosure process all together, we can help! I can’t speak for all investors in the area, but we will pay off your back due taxes and give you cash for your property. If you don’t want to stay in your home, I believe this to be the easiest route.